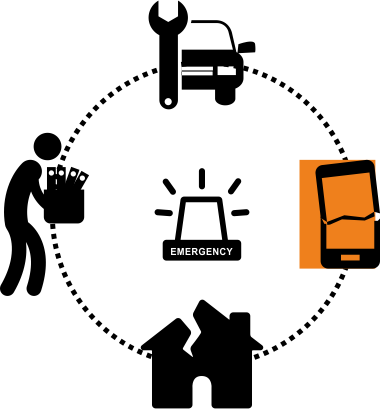

Emergency

EMERGENCIES DON’T KNOCK THE DOOR

Did ever emergencies tell you that they will be coming? No. Hence they never give you time to get prepared unlike other goals such as kids higher education or their weddings or your retirement etc. Emergencies can be as small as a loss/damage of your smart phone or as big as a temporary loss of income due to major illness or other mishaps. No matter how small or big they are, they can derail your finances and bring discomfort to your lives.

Expect The Unexpected & Be Prepared!!

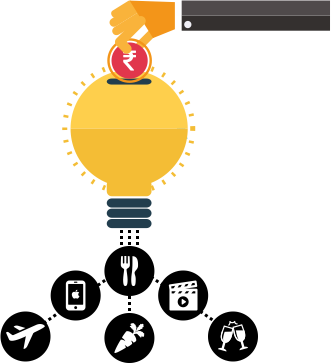

SAVING ACCOUNT IS NOT AN EMERGENCY FUND

Is your savings account your Emergency Fund too? If that is the case then there are chances that you may not be able to meet your day-to-day needs in times of emergencies. Savings account is that one stop solution which fulfills all your needs and can fulfill all your wants. Hence it’s difficult to control the urge of leaving that exotic vacation or that latest smart phone or that weekend party etc. just for fighting with those unforeseen emergencies that may or may not come.

What if emergencies hit you when you don't have enough money in account!!

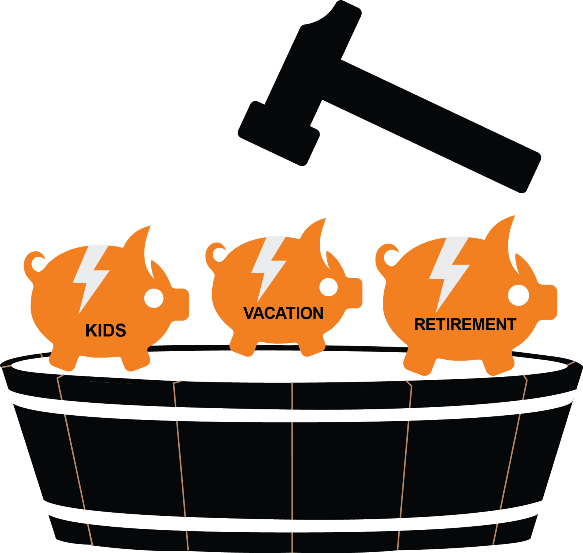

DON'T DIP INTO OTHER GOALS SAVINGS

Financial Assets offer the ease to withdraw at will. This often turns out as the biggest disadvantage when all financial assets are treated as money in hand. Emergencies create worrisome situations and leave us in despair. To combat such times we tend to dip into the savings done for other goals. If you will do it once, you will do it again and again whenever you need money,

Is it right to cater to present needs at the cost of future needs!!

ITS TIME FOR AN EMERGENCY BUCKET

It’s best to have a separate fund to cater emergencies. But what should it look like? How big should it be? Should you open a separate bank account or keep some cash reserves? The answer is Have a Liquid Fund. Liquid Fund is a new age financial tool and by far one of the best tools to build an emergency fund. Just like your savings account, liquid fund offers you the ease to deposit or withdraw money any time and offers more return than your Savings Account.

Once you have it, make sure it is equivalent to 3-6 months of your monthly expenses. Thinking how would you save it? Set up automatic monthly transfers from your account to liquid fund till you reach the desired goal. Remember, in emergencies we don’t fund vacations, new clothes or gadgets when your bank account does not let you do so.

Save whatever you can, even if it isn't much Someday you'll be glad you did!!

Aaditya Chhajed

Financial Services

© 2020, acfas.in. All Rights Reserved.